Why Recoop

Your home has insurance gaps. Recoop helps you cover them.

1 Environment America

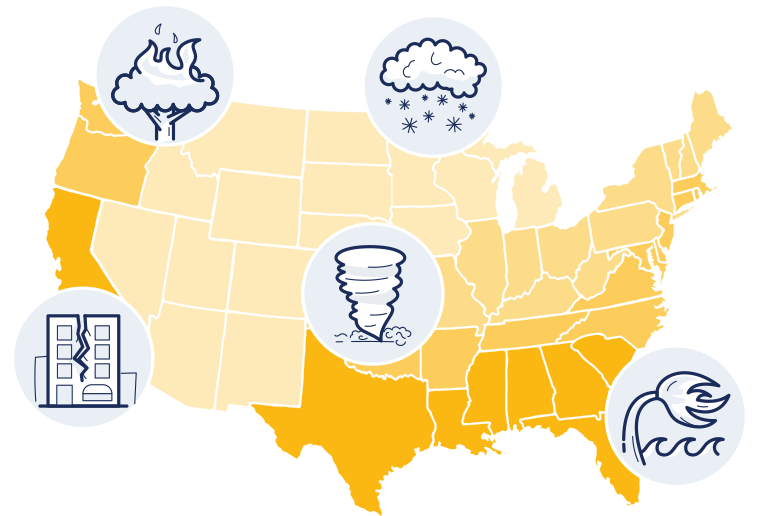

No matter where you live, you’re flirting with disaster.

Counties making up 97% of the U.S. population were affected by a federally declared disaster since 2010.1